One of the first questions I asked myself when I begun the development of portfolios within Asirikuy was : What if the profitabiliy of the trading systems used is very different ? What will happen if one system is much more profitable than the other one in the long term ? I started to wonder if the most unprofitable system would just drain out the profitability of the best one or if things would improve with time as the systems traded together. Today I will be writing the first part of a two part post which will talk about my finding around portfolio trading of uneven systems and the effect of doing these types of pair-ups in the overall draw down and profitability of a given portfolio.

In order to pair two uneven systems I needed to find two likely long term profitable systems that traded with similar frequency but which had significant differences in profitability that would become larger in the long term. The most suitable system I found was Watukushay No.2 which trades on both the EUR/USD and the GBP/USD. Although both instances are bound to be long term profitable, the EUR/USD instance achieves higher profitabilities in simulation due to the higher presence of the inefficiency exploited by Watukushay No.2 on this currency pair. By pairing up both systems I would be able to see the overall effect in long term portfolio trading allowing me to see if one system would be able to drain the other one or if - despite their differences in profitability - they would achieve a joint effort towards more profitable territory.

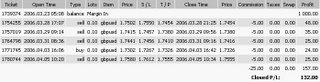

To make things even more interesting I decided to increase the Risk used on these tests to 5 also extending the backtests to include 2010 months up until May first. The results - shown below - let us see the big difference in profitability between the EUR/USD and GBP/USD instances of Watukushay No.2 as compounding effects become more pronounced. The contribution of the less profitable GBP/USD instance becomes less significant as time goes by and the EUR/USD instance starts to take a very important place within the portfolio. In the year 2009-2010, most of the position sizes taken are the responsability of the EUR/USD instance while the GBP/USD instance contributes about 5-10% of the trading volume. It is extremely interesting here to note that -in the long term - a portfolio setup eliminates unprofitable strategies by itself, since less account percentage is allocated as the instances fail to accurately perform, effectively protecting the account from the less perfoming strategies.

- -

-

However what happens during the whole ten year period ? What happens with the overall losing period length, maximum draw down, etc ? For the Risk 5 tests, the maximum draw down period length and the maximum draw down values for the EUR/USD instance were 658 days and 26.96% while for the GBP/USD instance they were 1026 and 59.41%. However, the portfolio achieves a wonderful effect and achieves - within the ten year period - to reduce the maximum draw down period to 433 days and the maximum draw down to 30.66% just a little bit higher than the EUR/USD instance and much lower than the GBP/USD instance.

-

-

-

It is also very interesing to evaluate the yearly profits of the portfolio (shown above) which allow us to see how the EUR/USD instance takes over as times goes by. Of particular importance is the year 2002 in which Watukushay No.2 achieves its highest profit on the EUR/USD (note that high risks exaggerate these effects), leaving behind the GBP/USD instance in terms of equity gains. As time evolves even further we note how the EUR/USD instance keeps growing the account and the contribution of the GBP/USD instance becomes very small. In the end, the profitability of the GBP/USD instance achieves a minor increase in average yearly profitability for the account, from 41 to 42% showing that the addition of this instance, eventhough much less profitable did add up to draw down period reduction and increases in profitability in the long term.

Of course, there are still several questions unanswered which will be addressed on the next part, released tomorrow. For example, what happens if we decide to start to trade a portfolio like this just before the worst draw down period of the worst performing system ? Will this expose us to higher risk ? Is the long term risk indicative of the highest possible draw down even when different starting periods are taken into account ? Tomorrow I will try to answer these questions as I continue to research the depths of the world of portfolio trading and combinations of Asirikuy systems.

From todays post we can definitely conclude that the best idea is to combine trading systems with similar profit targets, however if one of the systems does start to fail it is very probable that its trading contribution will be slowly eliminated by the account growth caused by the other systems. This is very powerful in the sense that the portfolio self-manages the profitability of trading strategies and automatically rewards systems that perform better and punishes systems that perform worse.

If you would like to learn more about automated trading system development and how you too can learn to develop your own long term profitable systems please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !

In order to pair two uneven systems I needed to find two likely long term profitable systems that traded with similar frequency but which had significant differences in profitability that would become larger in the long term. The most suitable system I found was Watukushay No.2 which trades on both the EUR/USD and the GBP/USD. Although both instances are bound to be long term profitable, the EUR/USD instance achieves higher profitabilities in simulation due to the higher presence of the inefficiency exploited by Watukushay No.2 on this currency pair. By pairing up both systems I would be able to see the overall effect in long term portfolio trading allowing me to see if one system would be able to drain the other one or if - despite their differences in profitability - they would achieve a joint effort towards more profitable territory.

To make things even more interesting I decided to increase the Risk used on these tests to 5 also extending the backtests to include 2010 months up until May first. The results - shown below - let us see the big difference in profitability between the EUR/USD and GBP/USD instances of Watukushay No.2 as compounding effects become more pronounced. The contribution of the less profitable GBP/USD instance becomes less significant as time goes by and the EUR/USD instance starts to take a very important place within the portfolio. In the year 2009-2010, most of the position sizes taken are the responsability of the EUR/USD instance while the GBP/USD instance contributes about 5-10% of the trading volume. It is extremely interesting here to note that -in the long term - a portfolio setup eliminates unprofitable strategies by itself, since less account percentage is allocated as the instances fail to accurately perform, effectively protecting the account from the less perfoming strategies.

-

-

-However what happens during the whole ten year period ? What happens with the overall losing period length, maximum draw down, etc ? For the Risk 5 tests, the maximum draw down period length and the maximum draw down values for the EUR/USD instance were 658 days and 26.96% while for the GBP/USD instance they were 1026 and 59.41%. However, the portfolio achieves a wonderful effect and achieves - within the ten year period - to reduce the maximum draw down period to 433 days and the maximum draw down to 30.66% just a little bit higher than the EUR/USD instance and much lower than the GBP/USD instance.

-

-

-It is also very interesing to evaluate the yearly profits of the portfolio (shown above) which allow us to see how the EUR/USD instance takes over as times goes by. Of particular importance is the year 2002 in which Watukushay No.2 achieves its highest profit on the EUR/USD (note that high risks exaggerate these effects), leaving behind the GBP/USD instance in terms of equity gains. As time evolves even further we note how the EUR/USD instance keeps growing the account and the contribution of the GBP/USD instance becomes very small. In the end, the profitability of the GBP/USD instance achieves a minor increase in average yearly profitability for the account, from 41 to 42% showing that the addition of this instance, eventhough much less profitable did add up to draw down period reduction and increases in profitability in the long term.

Of course, there are still several questions unanswered which will be addressed on the next part, released tomorrow. For example, what happens if we decide to start to trade a portfolio like this just before the worst draw down period of the worst performing system ? Will this expose us to higher risk ? Is the long term risk indicative of the highest possible draw down even when different starting periods are taken into account ? Tomorrow I will try to answer these questions as I continue to research the depths of the world of portfolio trading and combinations of Asirikuy systems.

From todays post we can definitely conclude that the best idea is to combine trading systems with similar profit targets, however if one of the systems does start to fail it is very probable that its trading contribution will be slowly eliminated by the account growth caused by the other systems. This is very powerful in the sense that the portfolio self-manages the profitability of trading strategies and automatically rewards systems that perform better and punishes systems that perform worse.

If you would like to learn more about automated trading system development and how you too can learn to develop your own long term profitable systems please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !

forex trading kaskus

-

- -

-

-

-